As marketers, practitioners, and strategists, we have our playbooks and toolkits and methods that we’ve found to work reliably.

As a result of the disruptions caused by social distancing and stay at home orders, search and social behavior has shifted so dramatically that prior KPIs and baselines may no longer be the measures we’re relying on.

If nothing else, a pandemic pulls the future forward, and there are immediate and longer-term strategies Finance companies can begin deploying now to address current circumstances, as well as what the ‘new normal’ looks like.

What Do Consumers Need Right Now?

Empathy, Patience, and Reassurance

53% of Americans don’t have an emergency fund, and 49% are living paycheck to paycheck.

-- Source

At this time, content about “money management” may seem incredibly tone deaf. There are folks in fear they won’t be able to buy groceries, and if they do they know they’ll come out of this event with an anchor of credit card debt and a lower credit score.

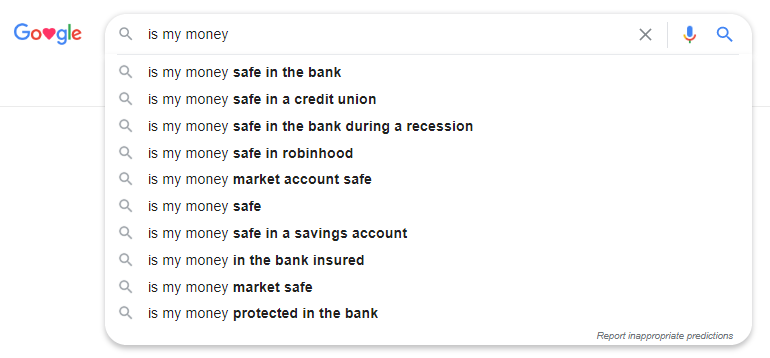

Understand that some of the things people are searching for right now aren’t just queries -- they’re cries for help.

See how your financial institution can minimize customer frustrations and improve your online banking experience.

What’s a Finance Marketer To Do?

Work Together & Eliminate Silos Holding You Back

Marketing is often not the only department needed to ensure the organization can provide the best solution for customers during times of uncertainty.

Remove barriers preventing cooperation between knowledge centers within your organization so that everyone is benefiting from shared information -- leading to a more positive brand experience for your customers.

Collaborate internally like you never have before. Now is the time to question assumptions and bust siloes. The result will be a more cooperative effort during these times of crises that can last and benefit your organization much longer term. Your email team should be in sync with your content marketing strategy. Your landing pages should reflect the brand voice used in your emails. Your ad copy should have consistent messaging with your direct mailers. And so on.

Know Your Customers’ Concerns

Simply put, many households don't have the financial cushion to weather an economic storm, and providing the information they need in a clear, organized way is what desperate families need from financial institutions right now.

The first wave of “emergency” searches are likely from those in dire straits with considerable financial stress.

Your emergency-phase content should include guides on “how to live on credit” and helping them better understand their situation as they enter the next “adaptive” phase when things recover -- with content including “how to pay off debt” for example.

We recently scraped Reddit for all of the Financial questions people currently have. This list takes away some of the heavy lifting by showcasing immediate content you can create to address key concerns.

Build Support Resources to Answer FAQs

Consider launching a custom FAQ page that provides customers with the comprehensive information they’re looking for (and spare them the extended wait times your call centers are likely experiencing). This will control your costs by reducing overall call volume, provide a more immediate and accessible response to someone’s query, and ultimately benefit both you and your customers.

Collaborate with call centers and pull data from your chat bots. In the case of call centers, these are human-to-human interactions that are going to provide rich context that can add value to anything related to your marketing strategy. Extract any themes from these discussions and build a dedicated resource center on your website that provides all the information your call centers are being bombarded with.

Ease the Financial Burden with Rates, Offers, Promotions

Outside of marketing - have a plan for reduced rates, deferrals, freezes - truly anything you can do as a business to help. Your help will literally affect the recovery and economy at large. Not to mention the lives of those in a financial emergency.

For example, we’ve seen some banks waive fees for withdrawing Certificate of Deposit (CD) funds early to help increase the liquidity of savings vehicles for their customers throughout stay at home orders and market uncertainty.

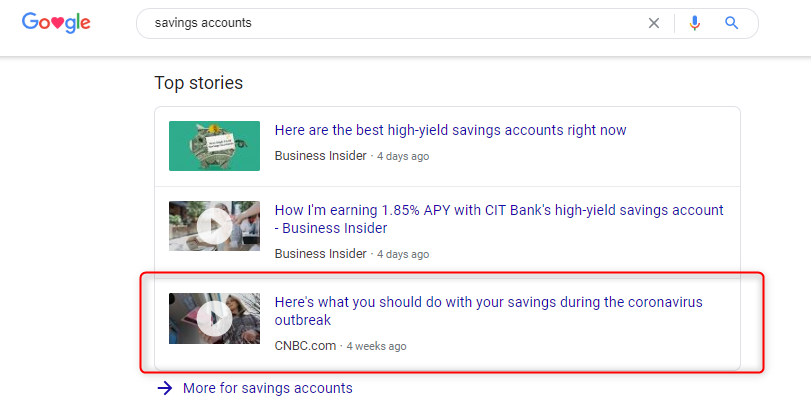

Searches Through the Filter of Fear

Intent Signals Changing

Be mindful that almost every search is one of tremendous uncertainty and fear because we aren’t up against a pandemic or a recession - we’re up against both.

“Banks near me” is less about a transactional, utilitarian search and more about someone needing to have a safe ATM available they can socially distance at or concerns that they can’t get the money they need with so many closures.

At the same time, they’re concerned if their money is safe in the bank. Search interest for the query “is my money safe in the bank” peaked in mid-March 2020.

Where Did The Data Go?

And if your normal tools aren’t providing data on monthly search volume (MSV) for certain queries -- it doesn’t mean people aren’t searching for them. Rather, search algorithms haven't run long enough to provide that data to you.

As a reactive and limiting data set, MSV is far behind what is very likely emergency types of searches. Looking at monthly search volume without thinking critically will show you false negatives.

You can utilize Google Trends to uncover some of these new searches in real-time if other tools currently can’t supply them.

Short-Term Digital Strategy Impacts

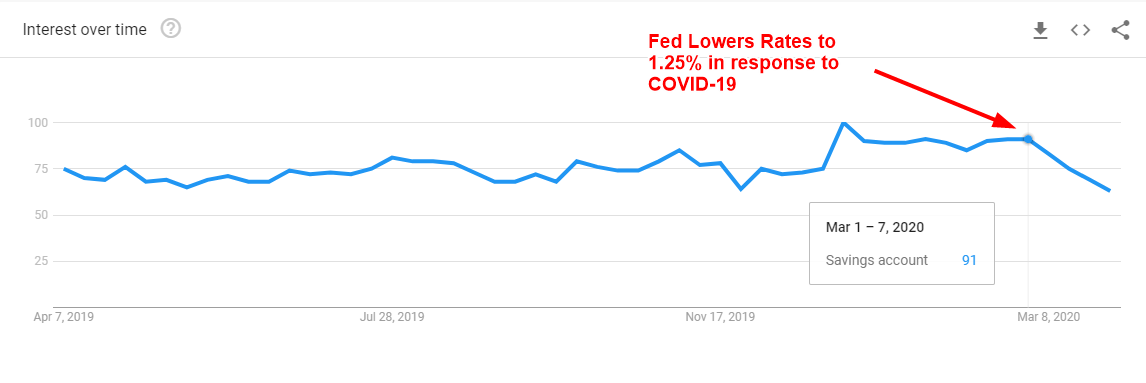

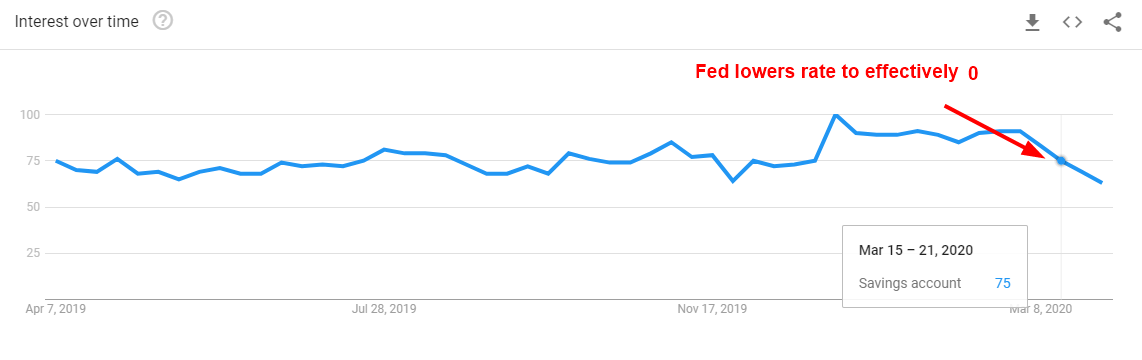

Typically, when the Federal Reserve decreases the federal interest rate - lending products become more desirable and savings products become less attractive.

Uncertainty for Savings Accounts

- In March the Federal Reserve slashed rates on March 3rd and March 15th, with the second decline bringing interest rates to near 0.

- Following these reductions, search interest in Savings Accounts declined.

Although there has been a decline in search interest to open a Savings Account, there is an opportunity to reassure existing customers that their money is secure in a savings account throughout stay-at-home orders and times of social distancing.

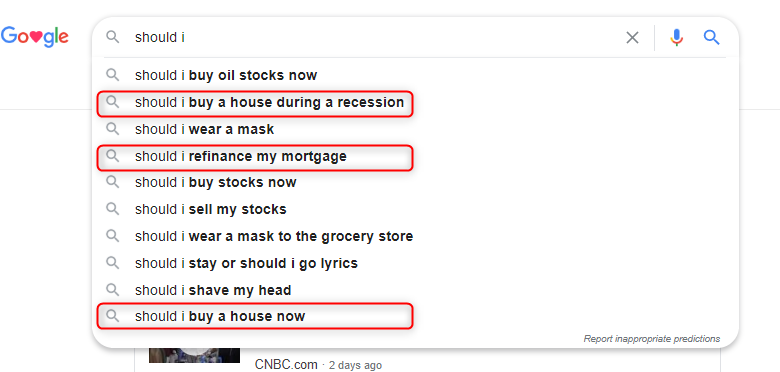

Opportunity Still Knocking

With low-interest rates, it’s not surprising that people are searching for ways to purchase homes or refinance their mortgages.

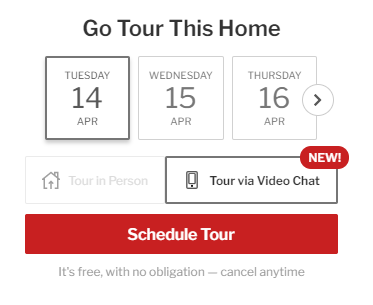

However, rates are not the only thing that has changed the housing market. For example, Open Houses are less likely to occur while people are practicing social distances. But many realtors and property groups are offering virtual tours for potential buyers to be compliant with stay at home orders:

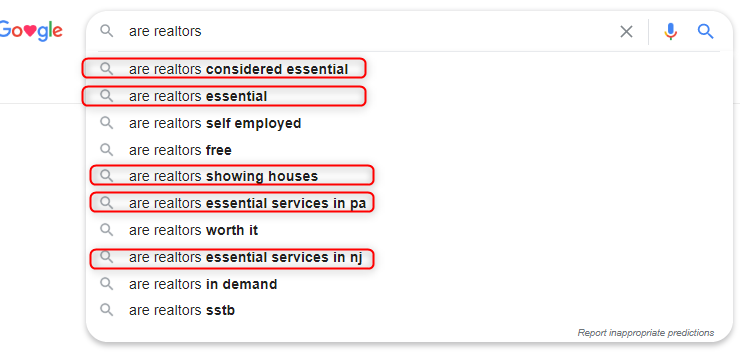

Additionally, people may not be sure if Realtors are considered essential personnel in states that have shut down all non-life-sustaining business.

These are things that financial institutions should take into account when answering home buying during a recession questions on their website.

Hyper-Sensitivity Toward Messaging

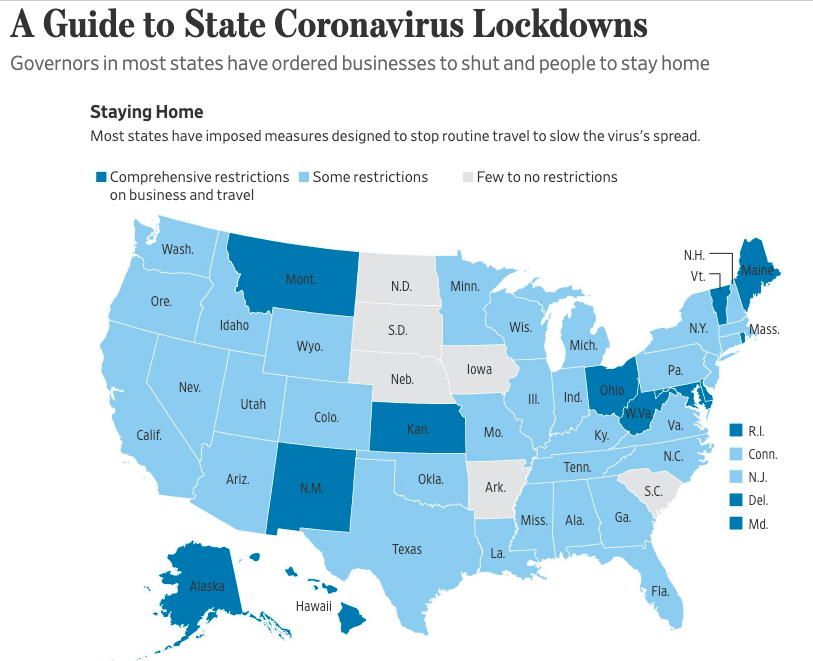

The majority of the United States is under some type of lockdown criteria:

Re-evaluate your digital assets: your site, ads, and social media imagery. Imagery should reflect social distancing - not images of people laughing together in a coffee shop, which is likely sending the wrong message for the current circumstances. Coffee shops are closed and people's income has been wiped out making even a cup of coffee a stretch for them financially.

With social distancing and stay-at-home conditions, your brand should visually demonstrate this in your messaging, otherwise how can you be trusted to help the rest of the needs on the pyramid?

Anxiety About Online Banking

If you have an app, be mindful those most affected may not have a luxury device like a smartphone. Some may also be technophobes or just generally lagging on adopting technology. This is your job to accommodate.

While a best-in-class app is an investment you should be striving towards, you also need a plan for how to help those who won’t use it.

In a recent survey, many Americans revealed their preferred bank experience was at a physical brick & mortar location, they had lingering fears and misconceptions about online banking, and had concerns about how online banks were insured.

- Nearly half of respondents in the survey stated their preferred method of banking is in-person at a branch or ATM. Among respondents, only 25 percent said they preferred banking with a mobile app.

- Their biggest fear around online banking was privacy, and the threat of someone stealing their account or personal information. 42 percent of Americans said they are more afraid of someone stealing their bank account information than not having a job, never being able to retire and incurring excessive bank fees.

How Can You Help This Audience Adjust?

Provide informative content and clear instructions for new online banking users -- such as “New to Online Banking? Start Here.”

The good news is a positive experience could turn a timid web customer into a digital consumer for life, all contributing to a positive brand experience.

There’s a learning curve to adopting any digital tools, and what may seem like common sense or second nature to some is intimidating and confusing to others.

Long-Term Digital Strategy Impacts

Every team in every industry has to reflect on its current operations right now.

One thing has become increasingly clear though -- if you continue to work in a silo you are leaving irreplaceable value on the table.

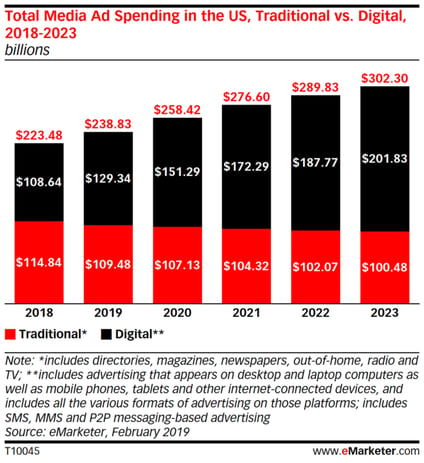

While major events like the Summer Olympics have been postponed, the NCAA’s March Madness canceled, along with a host of other premiere events canceled, postponed, or generally disrupted, what does this mean for the originally forecasted growth in digital marketing spend?

Originally forecasted comparison of digital vs. traditional media spend

Key Takeaways

Plan for more digital investments.

While immediate budgets are uncertain due to overall economic uncertainty, digital is more crucial than ever before. Online shopping and banking behaviors are VERY likely to remain in the future -- make sure to account for that moving forward.

Seer’s team of industry experts combines cross-channel insights to provide better data and make more informed business decisions. Get in touch with us today for how we can help your business get through changing times.

Sign up for our newsletter for more posts like this -- delivered straight to your inbox!