Facebook recently announced they will take strides to lessen the potential for discriminatory advertising practices by limiting the targeting capabilities for certain industries, including ads for housing, employment, and loans.

Previously, Facebook largely relied on advertisers to comply with its anti-discrimination policies but did not actively block them from using the targeting categories. Moving forward, Facebook will be building out a technological barrier that prohibits advertisers in this space from having those options to choose from.

What’s changing?

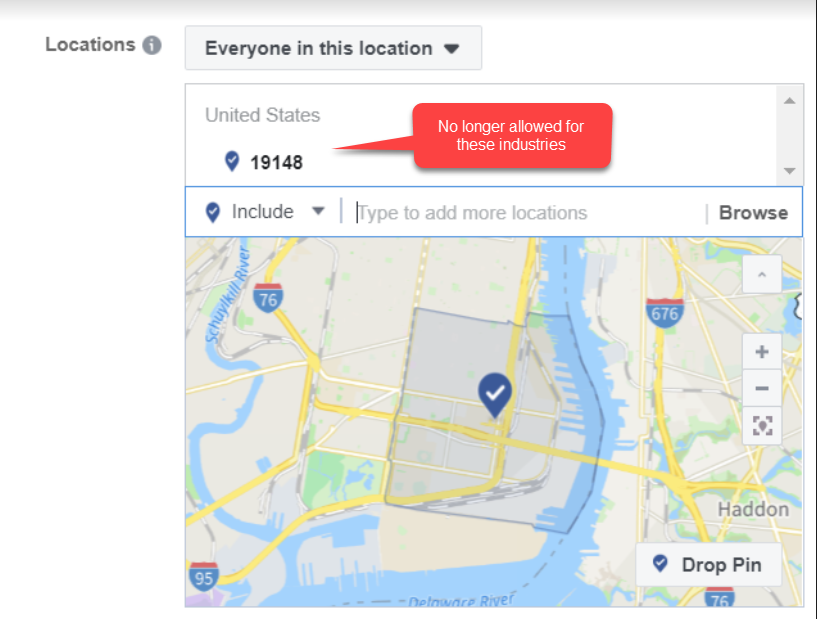

- For housing, employment or credit ads targeted to the US, Facebook will no longer allow the ability to target by age, gender, or zip code.

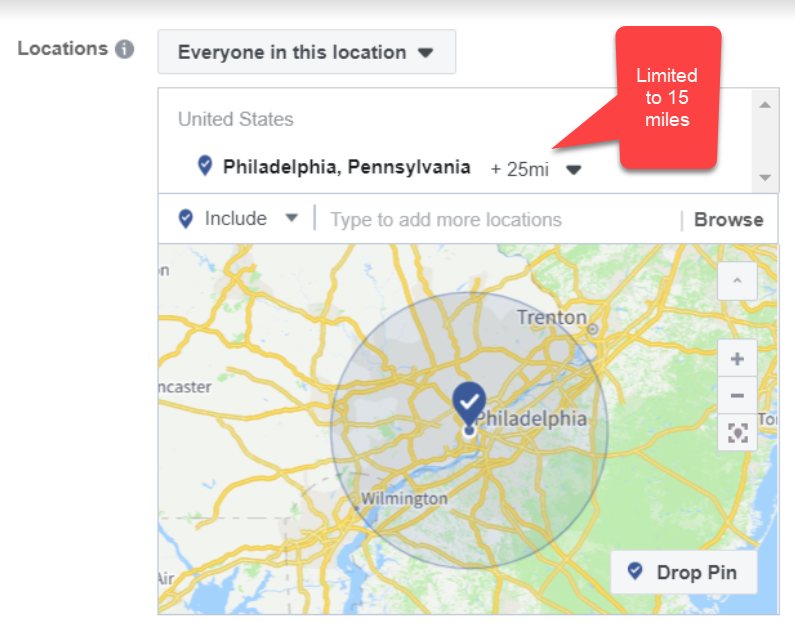

- Advertisers running such ads will only have access to a much smaller set of interest targeting options. Facebook is removing the ability to exclude Interests, will require location targeting to cover a minimum 15 mile geographic radius, and limit lookalike audience creation to only consider a more restricted list of factors.

- Moving forward, the smallest geography targeting available to these advertisers will be limited to a 15-mile geographic radius, which could potentially limit businesses like local banks or apartment complexes looking to engage with a specific neighborhood.

- In addition, Facebook is rolling out a way for people to search for and view all housing ads in the US targeted to different places across the country, regardless of whether they are in the target audience.

- Custom audiences should largely be unaffected, provided that additional demographic targeting is not layered on that is prohibited.

- Facebook is limiting the number of targetable interests available as to not potentially discriminate against a protected class like gender, religion, ethnicity, etc. Remaining interests in this space include terms like “apartment,” “credit card,” “renting,” “real estate.”

What does this mean for me?

If you advertise housing, employment or credit ads, expect a lot of changes. These changes will likely impact performance as your targeting criteria is likely to broaden. The potential impact with that means likely higher cost-per-lead, but also likely lowered cost-per-click and cost-per-1000 impressions.

As your audience broadens, it becomes less expensive to advertise since there is less competition for a smaller pool of users. However, your cost-per-lead may likely rise due to costs associated with targeting a larger audience in order to capture that same potential audience member as before. As the updates are made, expect to see fluctuations in your performance data and costs, as both Facebook and advertisers get acclimated to the new normal.

If you are currently running ads using any of these targeting options listed above, we recommend creating a retargeting audience and a lookalike audience from these users. You can also leverage Facebook audience insights to build new persona audiences based off the demographic data you see in audience insights.

In the meantime, if you have any questions and are looking for help, reach out! If you’re interested in leveraging Seer for your paid social needs, you may find more information here.