According to CMOs, What is the Outlook on Marketing Spend in 2020-21?

The first half of 2020 kicked off strongly, seeing year-over-year growth in global marketing budgets. Then, on the heels of one of the most transformative periods in recent history, we saw the world economy shift to crisis mode as the COVID-19 pandemic called for worldwide shut downs and stay-at-home orders. As brands pivoted to crisis communication and risk mitigation, we saw CMOs react similarly in response, pulling back spend to prioritize cash flow and ROI.

Now, six months later, as the world has begun to enter the recovery phase, CMOs are keen on what the new normal looks like for their businesses and how to rebuild the path forward in what is still an uncertain future.

Recently, Gartner released their Annual CMO Spend Survey, which surveyed 432 CMOs from March - May 2020. The survey revealed several themes as it relates to the outlook of marketing spend over the next 18-24 months that we’ll summarize below, with a focus on the impact to digital marketing:

- CMOs Have a Positive Outlook; Expecting to Rebound within 18-24 Months

- Spend Forecasts Prioritize Digital Marketing Over Traditional Media

- Value Outweighs Volume as Brands Look to Agencies as a Strategic Partner

- Looking To Existing Markets To Fuel Growth

- Doubling Down On Brand Positioning & Messaging

1) CMOs Have a Positive Outlook; Expecting to Rebound within 18-24 Months, Despite Risk of Second COVID-19 Wave

According to the Gartner study, 44% of CMOs expect budget cuts of 5% to 15% or more in 2020 as companies prioritized cash flow as the economy initially declined following the roll out of stay-at-home orders.

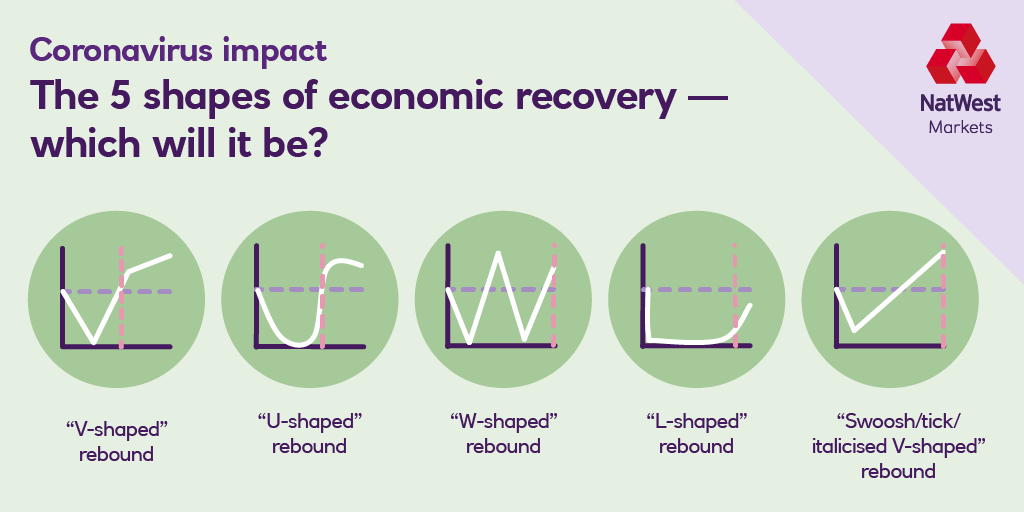

Despite these cuts, the majority of CMOs (73%) expect the current business and economic landscape to have a positive impact over the next 2 years, with more than half anticipating a positive rebound within the next 18-24 months. This “V” shaped recovery path echoes that type of rebound many CMOs expect in the coming months.

Interestingly, this contradicts the perspective of many CFOs. Financial forecasts predict there will be a second wave of the COVID-19 pandemic, resulting in additional economic instability. This trendline follows more of a turbulent recession shape known as the “W”. In this recession pattern, we see the economy decline, initially recover for a short period, and fall into another decline before finally rebounding.

Image Credit: NatWest

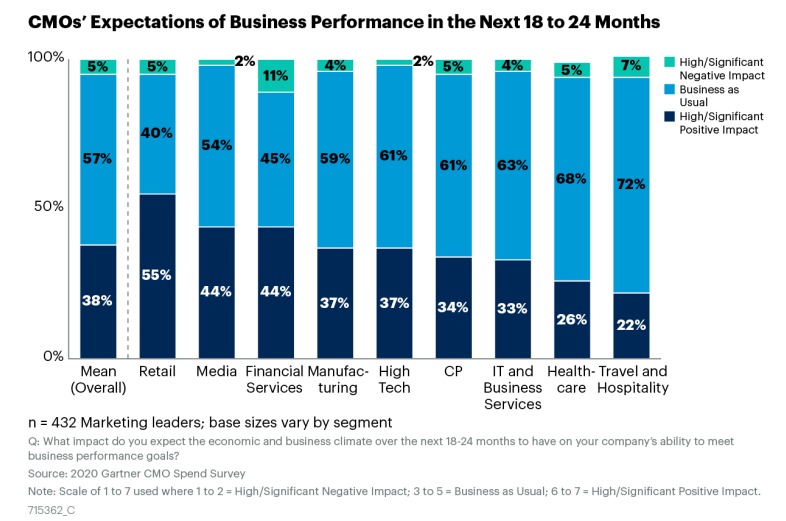

Of course, this sentiment varies based on industry. For example, below you can see that industries like Retail and Media saw a significant positive impact as people were stuck at home, leading people to grocery shop and consume media at a higher level than ever before.

On the flip side, industries like Travel, Healthcare and Financial Services saw a higher negative impact due to economic instability, and COVID-19 related shut downs leading to a decline in travel and non-emergent medical procedures.

Image Credit: Gartner

CFOs are prioritizing cash and identifying areas to cut back or reallocate spend to areas with highest profitability. As marketers, we should anticipate the potential for additional budget cuts, while also keeping a close eye on ROI to see if we need to take the scalpel vs. the sledgehammer approach.

2) Spend Forecasts Prioritize Digital Marketing Over Traditional Media

As people turned online at the onset of the pandemic while in-person events and traditional media were less in demand, digital channels became key to retain and drive customer demand, accounting for 80% of marketing budget. In fact, digital advertising dominated the channel mix within the survey, (22% of marketing spend). CMOs expect this spend to only grow in 2021 as focus shifts towards performance marketing.

The outlook for paid and organic search is especially bright, with search accounting for 1/5th of channel budget. Of note, 66% of CMOs expect to see spend grow for paid search alone.

As spend fluctuates for channels like event marketing given the shift to virtual events, CMOs commitment to channels that can show proven ROI will be certain to be prioritized over other channels.

This is a great opportunity to take a step back and give a holistic view to your strategy and ask yourself:

- What levers are providing the most payoff in terms of ROI?

- Where can I pull back, protect or double down on my strategy to lead with business impact?

- What metrics are key for me to review on an ongoing basis in order to be flexible with pivoting based on the changing environment?

3) Value Outweighs Volume as Brands Look to Agencies as a Strategic Partner

A major area where CMOs looked to scale back spend was shifting external agency work to in-house teams, as these fees accounted for nearly 24% of overall marketing budget. However, this had an opposite effect.

While more work was shifted in-house, external agency spend increased. This was due to companies looking towards external agencies for help with larger, strategic projects. So while in-house teams took on a higher volume of work, this was typically for lower cost tactics like content production and social media vs. higher value projects agencies were better suited to take on.

Look for opportunities to align budget to capabilities best suited for in-house vs. agency partners by balancing short-terms costs vs. ultimately accomplishing a higher ROI for higher value projects that may benefit from leveraging an agency for.

Not sure about hiring an agency? Check out the following resources:

- Should I Hire an Agency for PPC?

- Should I Hire an Agency for SEO?

- Should I Hire an Agency for Analytics?

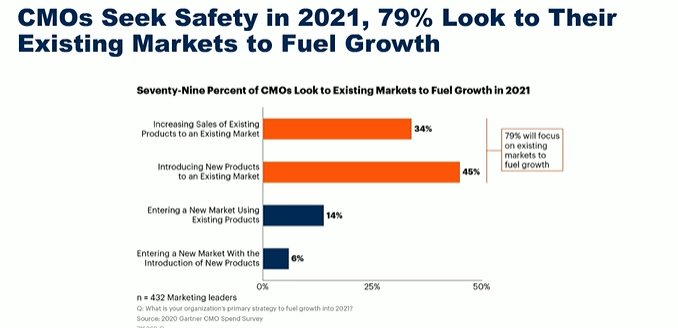

4) Looking To Existing Markets To Fuel Growth

Not surprisingly, CMOs are focusing on customer retention and lifetime value during such an uncertain time. CMOs are focusing on fostering strategic partnerships, R&D, and further refining their product offerings in order to convert more brand loyalists.

During the last recession in 2008, certain brands were rewarded for making riskier investments. Today, however, only 20% of CMOs are placing bets on entering new markets with existing products, or introducing new products to a new market.

From a digital perspective, CMOs and practitioners alike need to focus on maximizing each and every interaction that existing and potential customers have with their brand.

Below are some thought starters that we’re asking our clients to ensure that they are converting more qualified traffic and doing just that.

- How can we improve your loyalty program?

- What’s the value of 1 email address, and how are you capturing email addresses when visitors land on-site?

- Where are there opportunities to increase average order value? For example in post-checkout email flows

- What do your product bundles look like, and how are they being positioned on your website? (increase AOV)

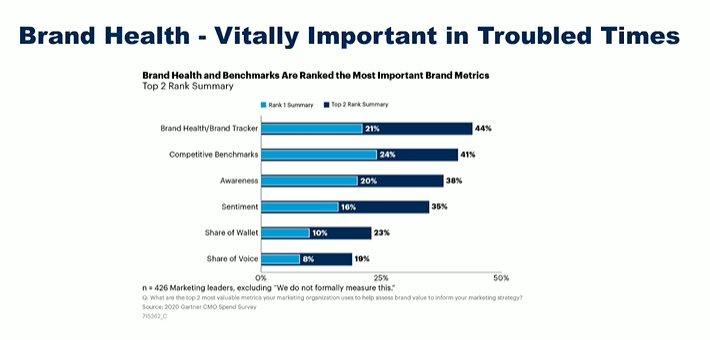

5) Doubling Down On Brand Positioning & Messaging

Brand strategy again surpassed Analytics as the most vital strategic capability in 2020 as ranked by CMOs.

This makes sense, as in times of significant upheaval, crafting messages that align with your audience is extremely important in order to drive brand loyalty and reach new, relevant audiences. Interestingly, Analytics has lost significant ground YoY. CMOs cite the inability to prove the value of Analytics or ability to build Analytics maturity in a meaningful way as the top reason.

Below are how CMOs are measuring brand health in 2020:

Brand and Analytics are not mutually exclusive, and a fundamental Analytics set up is critical in analyzing and optimizing brand health.

Seer POV

At Seer, we measure indicators like brand health and the total addressable market size by using our data warehouse, which allows us to look at all of our client’s data within one platform in order to find specific and broader reaching trends.

Our data warehouse centralizes data sets across PPC, SEO, Analytics, and external inputs, allowing us to see and act upon trends in real time. For us, it goes beyond brand health. At Seer, we see search data for what it is: some of the most detailed consumer trends and behavioral data you’ll find anywhere.

Below are some of the questions that we like to answer using the data from user’s behavior.

✔ Strategic Marketing Roadmaps

✔ Market Intelligence

✔ Digital Diligence

✔ Media Efficacy

✔ Location Expansions

✔ Product Naming

Learn more about our marketing business intelligence offering and get in touch!

In Conclusion

After starting the year off full of uncertainty and an increased need for agile response to worldwide shut downs and stay-at-home orders, CMO’s continue to be risk averse and ROI-oriented as it relates to spend approach.

Marketing budgets and strategies have been significantly impacted in 2020, though most CMO’s expect to return to positive future performance. In-housing has failed to reduce spend with external agencies, and digital marketing channels are dominating, with a strong and growing commitment to digital ads. Brand strategy has jumped to the top of CMO’s strategically important capabilities, reflecting the need for meaningful brands in difficult times.

Below are some of the questions that we believe all CMOs and digital strategists should be asking in the COVID-19 era:

- Are my plans flexible and adaptive, and am I willing to pivot? Do I have the right tools, processes, and insights to evolve strategically in the changing environment?

- Am I focusing on my most profitable customers?

- Do I have KPIs in place for technology investments?

- How am I measuring brand health, and am I investing enough compared to other strategic capabilities? How quickly can I measure brand health?

- Am I using data to rapidly test, monitor, and adjust evolving customer journeys?