Our philosophy at SEER on the role of analytics for clients is pretty simple. Our goal is to provide the right information at the right time so that client decision makers can make better decisions with greater confidence. This goes far beyond basic reporting and actually starts with a deep understanding of client strategy (digital strategy or otherwise), the stakeholders involved, the decisions being made, goals and so on. We refer to this process as strategic analytics reporting and I'll cover that in a future blog post. I mention it here simply to convey the importance of first understanding the decisions the client is grappling with. Once we understand the questions they need answered, then we can use that information to determine which on-site user behavior needs to be tracked and what needs to be measured.

In all cases our reporting would ideally “tie to cash” or to the strategic goals most important to our clients.

For B2B clients, a beguilingly simple question we hear often is, "What's the return on my marketing channels?" Sometimes a CMO can shift budget across channels and he or she is trying to determine which one(s) should get the extra investment.

The problem is that it's historically been difficult for us, the client’s agency, to get an accurate picture of lead behavior downstream from the client's website. To get at the solution, let's further unpack the dilemma.

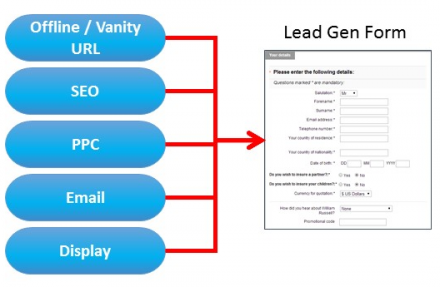

As digital marketers, the goal of our efforts to develop compelling content, implement innovative SEO strategy and run sophisticated PPC, display, and email campaigns is to drive target audiences to the most prized and magical of on-site conversions, the "lead gen form".

Your company may know the lead gen form by another name: Request a Quote, Request a Demo, Contact Me, Learn More, etc. When a user on a B2B client website clicks submit on the lead gen form, we often count it as a conversion in Google Analytics. Our brothers and sisters on the SEO and PPC teams take this particular conversion very seriously. It's a major KPI on our client accounts, and we measure and report on conversions religiously.

Conversions are our wins and our clients' leads, and we take great pride when the chart shows "up and to the right". And we should! But there's a problem...

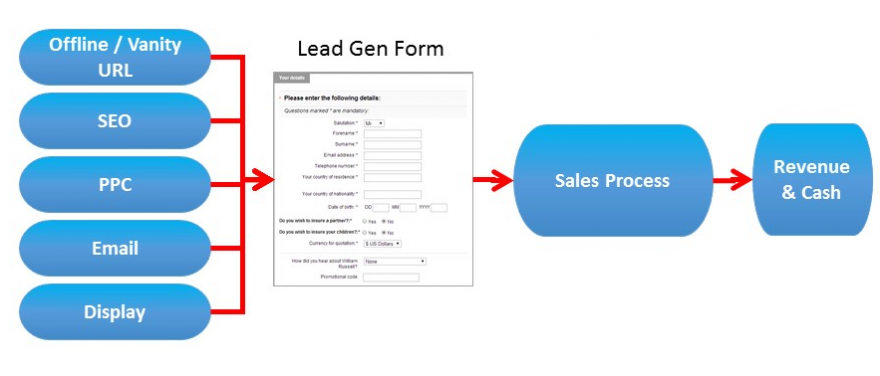

For our B2B clients that conversion, the otherwise logical end of a significant amount of work on SEER's part, is actually just the beginning of an often long and arduous process for our clients: converting that lead into cash.

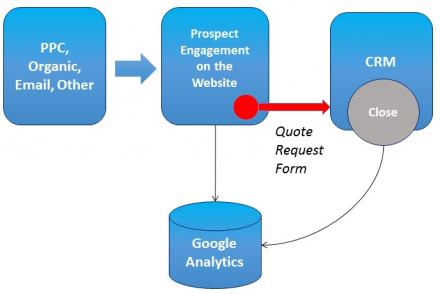

The other end of that lead gen form submit button may be a customer relationship management (CRM) or lead nurturing platform such as Salesforce.com, Marketo, Hubspot, or perhaps a custom, "on-premise" CRM system.

Once the leads are in the CRM system, they get farmed out to live sales people who then contact those leads and start grinding them through the sales funnel. Some of SEER's B2B clients have high price point services and a part of that sales process could include air travel and face-to-face visits, sophisticated proposals and contracts, and, ultimately, a closed sale. The bottom line is that for many of our B2B clients the cost of sales acquisition is pretty high, and each successful sale has to cover the cost incurred for leads that don't close.

With a successful digital marketing strategy, we (as digital marketers) are ideally driving tons of high quality leads to that B2B client's sales team. Again, the temptation is to think of our job as done. But just what does, "high quality" mean? Let's look it from the salesperson's perspective.

Many salespeople have some type of incentive mechanism as part of their compensation and, classically, they work on commission--sometimes 100% commission. They eat what they kill and time is literally money: time spent on leads that don't close means there is less time for working the leads that will. Another way to think about it is that the opportunity cost for working a (poor quality) lead that won't close is extremely high.

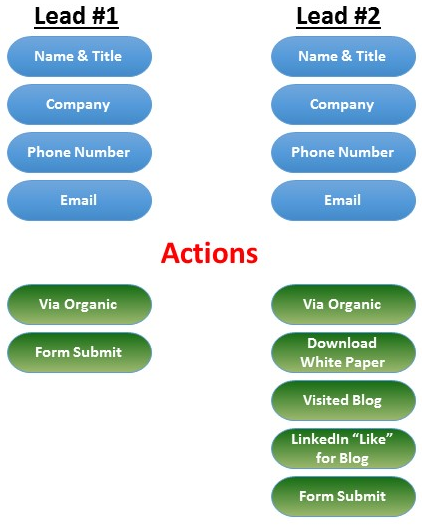

When these folks get leads from the website--from that prized lead gen form!--the leads are all same: Name, Title, Company, Address, Phone Number, Email Address.

So, what does this have to do with Closed Loop Reporting, client strategy and above all, analytics?

Well, what if the leads that flow from the lead gen form aren't really the same. Consider the two leads below that land in a salesperson's inbox:

Our salesperson has precious time (time is money!) Which lead should she call first? Absent any other information about those leads, each lead is equally likely to close so she chooses #1.

Now suppose that we had had specific knowledge about what both those two leads did on the website prior to filling out the lead gen form and clicking submit:

Now which lead should our busy salesperson call first? Lead #2, of course.

Obviously lead nurturing and scoring software can do much the same, but let's look at the last piece of the loop: generating cash.

A B2B client often makes money not on the website, but off-line, with salesperson sitting across a negotiating table, with a live client. That salesperson updates the status of the lead in their CRM tool along a defined conversion path such as: Qualified Lead, Sales Qualified Lead, Proposal, Contract Under Review, then Contract Closed. It's that last step that actually generates revenue. And note that, typically, when we as digital marketers drive traffic to our clients' sites and they click submit on the lead gen form, we typically have no idea what happens to those leads.

But also note there is a mirrored dilemma: our clients have no idea where closed web customers came from or what they did on the website. The implication of this fact is pretty profound. Unless there is a way to directly tie on-site user behavior to downstream CRM sales activity and to a closed contract, there is really no way to accurately (or certainly, easily) calculate a digital channel-specific ROI.

Now, we can, and do, calculate a conversion value based on sales close rates, average sale amounts and so on, but this data is only as accurate as the information our client has available and it is not refreshed frequently. Also, in using an average sale value we preclude the possibility that different channels yield different contract values or margins.

And this brings us back to where we started: client strategy and goals. If a B2B client's goal is to understand which channels are driving the most sales, today we have a pretty significant data gap if we can only track the user to the lead gen form. We can report on which channels generate the most leads, in aggregate, but we don't know which ones actually close or with what dollar amount.

For the past several months SEER has been working with B2B clients to close this data gap using Universal Analytics. Using Universal Analytics we can pass a unique identifier downstream to client CRM systems when the lead gen form is submitted. Then, as leads move through the sales process and the salesperson updates lead status in the CRM tool, those status updates along with the unique identifier are pushed to GA. The last status update, Contract Close, say, can be passed to GA along with the contract dollar amount.

What this means is that we can report, out of Google Analytics, on actual closed revenue (or net revenue, gross margin, contribution margin, etc.) per channel or against any other dimension of strategic interest. It also allows us to more persuasively recommend that B2B clients adopt trackable strategies for their off-line advertising. We can shine light there too. For clients wondering what the return on their investment in outdoor advertising might be, we can provide directional, but clean data.

This data is also a boon for our SEO team as they can better target content and community outreach. Our PPC team can better test campaigns and ad copy, and more accurately aim ad spend. They can also run highly-tactical remarketing campaigns driven by the CRM status updates.

Essentially, we are linking Google Analytics to downstream CRM or other systems that include revenue generation. This is closed-loop analytics.

The Closed-Loop Reporting approach for analytics is not just for B2B sites, however!

We recently wrapped up a project for a B2C site. The company wanted to better understand how customers engaged their content once they logged-in to the customers-only section of their site. For this client we passed the user's unique customer number to GA from the website when they logged in. Each night, customer on-site behavior is pulled down into the client's data warehouse via the GA Reporting API, and is then joined with existing ecommerce data. By better understanding customer content engagement as a function of purchase levels, frequency and so on, our client can intelligently develop new content for online and offline marketing purposes and test new customer-only content ideas.

Have you implemented Closed-Loop Reporting at your company or for your clients? I'd love to hear about it!!! Please comment below! And if you'd like to learn more about SEER's approach to helping clients be more strategic with analytics, drop me a line.