“I can’t wait to do some sloppy ass work today."

Nobody says that, right? But we do it. Me included. Most of the time we’re not intentionally sloppy but it happens because we’re either rushing to ‘just ship it’ or we don’t know better. Of all the practices that fall within the discipline of marketing, the processes people use to design marketing strategies are some of the sloppiest.

Sloppy marketing strategies have two common traits:

- The strategy is designed without a theme and out of sequence

- The strategy isn’t supported by an opportunity analysis (i.e. the ‘why’)

Great marketing strategists are precise and imaginative, but rarely sloppy.

Precise and imaginative marketing strategies

A few years ago my team helped me put together a marketing campaign to persuade people to buy a high-dollar product by a certain date. The whole campaign bombed. The landing page converted at 0.46% when other landing pages we built at the time converted between 11% and 24%.

I felt horrible about the whole thing because it made my team look bad and not as talented as they truly were.

What went wrong: a mentor helped me understand that although it was a smaller campaign, I should have performed a market opportunity analysis to at least inform the campaign’s goal, objectives, and tactics.

The entire strategy was designed out of sequence. But worst of all, I completely failed to consider the people I intended to reach out to. What problems was that particular group of people facing and how should I use this campaign to present a solution in a persuasive way?

I didn’t know. I was more focused on aesthetics than relevance.

Theme and sequence

Theme and sequence hold a marketing strategy together the same way the phrase “and then” holds a story together. Like… and then he went in for the kiss and she poured her drink on him…

Notice those Matroyshka’s have a theme and sequence? From Yeltsin to Nicholas II, the Matroyshka’s tell a story about Russia’s complex political history over the past 100 years. In the same way Matroyshka’s follow a particular theme and sequence, an effective marketing strategy follows a theme and is crafted in sequential order.

Instantly know if your marketing strategy lacks theme and sequence

You can instantly know if your marketing strategy lacks theme and sequence by this signal: you begin developing your strategy based tactics, not based on an opportunity to offer something of value to an audience or community.

The first step in the sequence of crafting an audience and community focused marketing strategy is to perform a market opportunity analysis.

How to Perform a Market Opportunity Analysis in Three Steps

This Market Opportunity Analysis Process has been used to validate:

- Product Opportunity

- Audience Opportunity

- Community Opportunity

- Marketing Campaign Opportunity

- Content Opportunity

None of this is theoretical.

It’s the exact process we used to earn executive level buy-in and resources to develop, launch and market a new product that would be the first of its kind for our audience. Initial rollout of the product exceeded sales goals by 48% and the client feedback was more positive than expected.

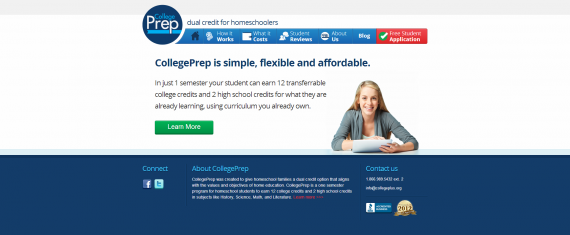

I’m no longer with that company, but I’m told it still has the highest lead-to-conversion ratio of all their products. Here’s a screenshot from the first landing page we built to introduce this product to the market:

Step I: Define Problem Statements

Marketers that can be considered craftsman understand two things exceptionally well: business and people. They are craftsman because they identify problems people have and understand how marketing fits with the other two pillars of business, innovation and growth.

Your opportunity analysis process starts by defining and articulating problem statements.

Two types of problem statements you need to define

- Your problem statement

- A community and audience’s problem statement

Marketing strategists first define a problem statement and then get validation by finding an audience or community that voices a similar problem. The two problem statements do not have to be verbatim, you’re just looking for similar context between the two problem statements.

A problem statement answers the following questions

- What is the problem I’ve identified?

- Who is this is a problem for?

- Why does this problem need a solution?

- How are we currently succeeding and failing at solving this problem?

- What makes us uniquely equipped to truly solve this problem?

Real example of problem statements

As the marketing strategist or product designer, you make the first problem statement.

For the product I created, this was my problem statement:

“Homeschool parents and their motivated students ages 13 to 17 do not have a flexible, personalized and affordable option to earn transferable college credit in high school, and are forced to use antiquated options that were created 50 years ago for traditionally educated students.”

The community’s problem statement:

“We want our homeschool students to be able to earn transferable college credit in high school but we don’t want to use Advanced Placement (AP) because the rules and requirements are too rigid and restrictive for our style of education.”

Those are the two problem statements my research showed was my problem statement ultimately led to the creation of the product I referenced above.

How this problem statement was informed and validated by the community

- By attending homeschool conventions and talking to homeschool parents and students that were either frustrated by AP but used it anyway, that wanted to earn college credit in high school but not through AP, or that didn’t know high school homeschoolers could earn college credit as young as age 13.

- By surveying prospects in our sales funnel- surveys were sent to parents who identified themselves as having students ages 13 to 17, but didn’t buy our main product. The surveys were designed to get feedback in a way that tested the respondents’ behavior.

- Connecting with homeschool thought leaders, educators and college professors to get their thoughts and opinions about my idea to create a personalized program for homeschoolers to earn college credit in high school but to also gain critical thinking skills and to develop emotional intelligence, two core competencies that are required for success in life.

The two problems statement were not developed and validated overnight. I spent about three months doing the research, gathering feedback, testing behaviors against potential user responses, and collecting advice from thought leaders.

I’m not suggesting you spend three months defining problem statements, especially if you’re performing a simple opportunity analysis for a marketing campaign. Adjust accordingly. The reason why I spent three months articulating problems statements is because initial research showed that the product had 8-figure revenue potential.

If you can’t clearly define the problem you’re trying to solve, do one of two things. Take a step back and rethink your idea. Or, move on to the next idea. If you get past this very first step, keep going to step two- gap analysis.

Step II: Gap Analysis

Now that you have data and initial validation to support truth behind both problem statements, your next step in the sequence is to perform a gap analysis to answer these two questions:

- How are we currently succeeding and failing at solving this problem?

- How are other companies currently succeeding and failing at solving this problem?

If you remember back to the problem statement phase, you sought a brief answer to the first question, but now it’s time to get a deeper understanding so that you can begin to understand more clearly how you can create an opportunity by solving a problem.

Here’s what I did to understand how our company was succeeding and failing at solving the problem I identified:

Talked to people. That’s about it.

Who I talked to from the company during the gap analysis phase:

- Board members and executives

- Academic advisors

- Salespeople

- Curriculum specialists

- Student mentors

- Business development

- Moms who were on staff and that had homeschooled high school students

I interviewed them, surveyed them, and asked for their advice. I was looking for commonalities and consensus about how we were truly succeeding and failing at solving the problem, and if there was truly an opportunity for us to help people.

Here’s what I did to understand how other companies were succeeding and failing at solving the problem I identified:

Again, talked to people:

- Education Technology events

- Met with Education Technology innovators and though leaders

There was also strong research component to this step in the sequence:

- Educating myself about the nuances of Advanced Placement (my competing product)

- Gathering relevant and correlated data from the public and private sector

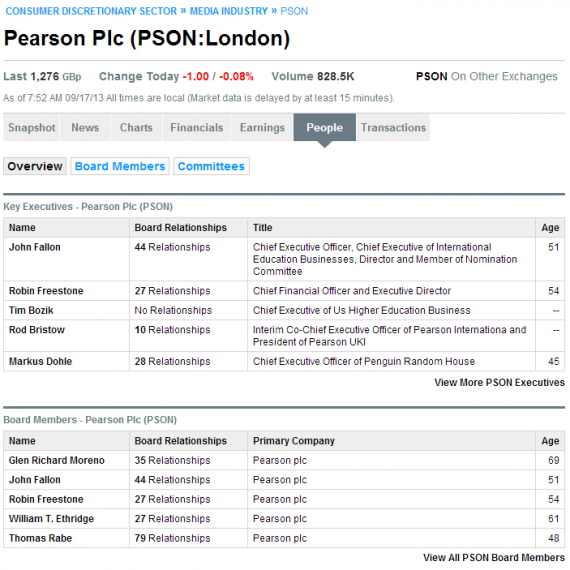

- Using free search tools like Crunchbase and Bloomberg’s Company Insight Center

Why Crunchbase and Bloomberg? To see the companies our key competitors were acquiring, who they were hiring, and who their executive teams were connected to. This information was vital to me because it gave insights about current and future moves these competitors are making to solve the same kind of problem I’m trying to solve.

Take a look at what Bloomberg could tell me about one of our competitors, Pearson:

In the ‘people’ section you can see the relationships their board and executive teams have with other people, who those people work for, and who they’re connected to. In the ‘transactions’ section you can see Pearson’s acquisitions which can inform how Pearson may be positioning themselves in the market.

That all may sound like an expensive exercise but I probably spent less than $500 on the entire gap analysis phase of the sequence.

The best advice I can give you for successfully navigating your way through this phase in the sequence is to approaching your gap analysis focused on people, competitors, competitor relationships, and market innovation.

Take good notes, document your findings, and gather screenshots during your gap analysis. When you finish your entire market opportunity analysis and report on your findings, the gap analysis section of your report should have some heavy show-n-tell happening.

In order to proceed to the final step in the sequence, your gap analysis should provide reasonable evidence and proof to answer these questions:

- Have we identified any competitors filling this gap? And if so, how and to what degree of success are they filling the gap?

- Are we filling this gap? And if so, how and to what degree of success are we filling the gap?

Alright, we’re almost done.

Step III: Market Opportunity Analysis

This can be the easiest and most enjoyable part of the opportunity analysis process because it’s all about audience and community (i.e. the market). Here, you circle back to the audience or community problem statement you articulated at the beginning of the process, but now you need to figure out why this is a problem for the market, and how this problem affects their behavior.

Specific objectives you want to achieve during your market opportunity analysis are:

- Understanding and defining who your potential target market or audience is

- Current size of your potential target market or audience

- How much market share you currently have vs. the amount of market share your competitors have

- Future growth potential of your target market or audience

- Knowing the various marketing and social channels you can use to reach your potential target market or audience

Here’s all I did to perform a market opportunity analysis for the product I reference above:

- Collected demographic and people data from government and private sector sources

- Surveyed and tested the behavior of the target market and audience I identified in my problem statement

You can access an extensive list of data resources that is well-curated by a fellow marketer, Sean Revell. For the surveying and testing part of the market opportunity analysis, I focused on gathering insights and intel from two specific groups of people:

- Prospects that were in the pipeline, that had students in our target age demographic, but did not buy our main product offering for whatever reason

- People that were in our target market and audience (identified in the first part of the market opportunity analysis) but had never heard of our brand and were unfamiliar with our product offering

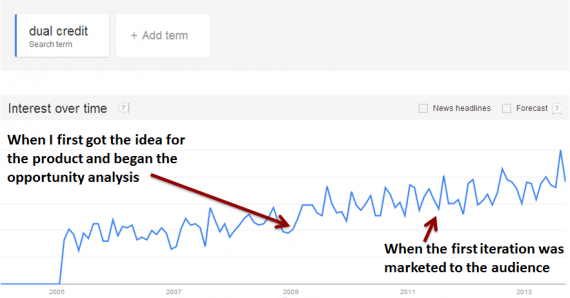

And of course, you can use old favorites like Google Trends to market interest or demand. Going back to the product example used throughout this post, take a look at the search trend data for the keyword, "dual credit". Dual credit is the term used to describe college credit earned in high school.

Why I surveyed and tested those two distinct groups- because I was looking for each group to independently validate if they wanted a solution or not. And if they did, what kind of solution they would like, what would a fair price be, and who would they trust to provide that solution.

This is the final test I conducted before finishing the market opportunity analysis:

I took all of the data, research, and learnings gathered up until this point. Based on that, I created a mock version of the product and presented it to people in our target market, in the form of a survey, to get their feedback. Basically, the survey was designed to answer the following question, “If there was a product that did A, B and C for your student and gave them X, Y and Z, would you buy it?”

Now you create the story

Remember your goal here is to be an effective and trusted marketing strategist who doesn’t make sloppy mistakes. And ultimately, you want to get the support you need to build your product or launch your campaign because you believe it and you have data and other people supporting you. After you’ve successfully completed each step in the sequence, now you are ready to present your findings and make recommendations, but how you do that will depend on the goal and objectives for doing this work.

For me, it meant I had to present all of this to a board of directors that had former executives of Fortune 100 companies that had a relatively low tolerance for crappy ideas. The last piece of advice here- if you go into this whole process thinking about it like a story, you will probably encounter twists and twists and complex unexpected scenarios come out of nowhere, and character types may change. But if you approach it this way, when you do walk into a meeting with an executive team, a boardroom, a client, or even your own colleagues, you can tell them a story about the opportunity, about the people you want to help, and why.

Last thing, here’s an excerpt for Marissa Mayer’s biography that was recently published that I would like you to read. The context is that Mayer was meeting the people at Yahoo that had the power to make her the next CEO. We’ll never know for sure, but I imagine Mayer went through a similar process to prepare for what was the most important meeting of her career to date.

From Business Insider:

On the evening of June 24, Mayer arrived at Wolf’s modern, Fifth Avenue apartment. An informal dinner was served. Mayer read for the part of Yahoo CEO. Throughout the conversation, Mayer touted a surprisingly thought-out plan for overhauling Yahoo’s culture, executive suite, and product line-up. After Mayer left, one of the board directors said to Citrin: “That’s the next CEO of Yahoo.”